Ethiopia's Marburg Virus Outbreak

Ethiopian health officials reported the Marburg virus outbreak after being alerted to suspected cases in the Jinka area. The Africa CDC confirmed the presence of the virus, which is known for its severe symptoms, including bleeding, fever, and vomiting, and has a high fatality rate. The World Health Organization's Director-General, Tedros Adhanom Ghebreyesus, noted that the virus strain detected shares similarities with those previously identified in East Africa. The Ethiopian government has initiated epidemiological investigations and laboratory analyses to contain the outbreak and prevent further spread within the region.

Response and Containment Efforts

Health authorities in Ethiopia have acted swiftly to confirm and manage the outbreak. The Africa CDC has pledged to collaborate with Ethiopian officials to implement an effective response strategy aimed at reducing the risk of the virus spreading to neighboring countries. The Marburg virus is transmitted through contact with infected bodily fluids, and there is currently no approved vaccine or antiviral treatment available. Supportive care, including rehydration, is crucial for increasing survival chances among those infected.

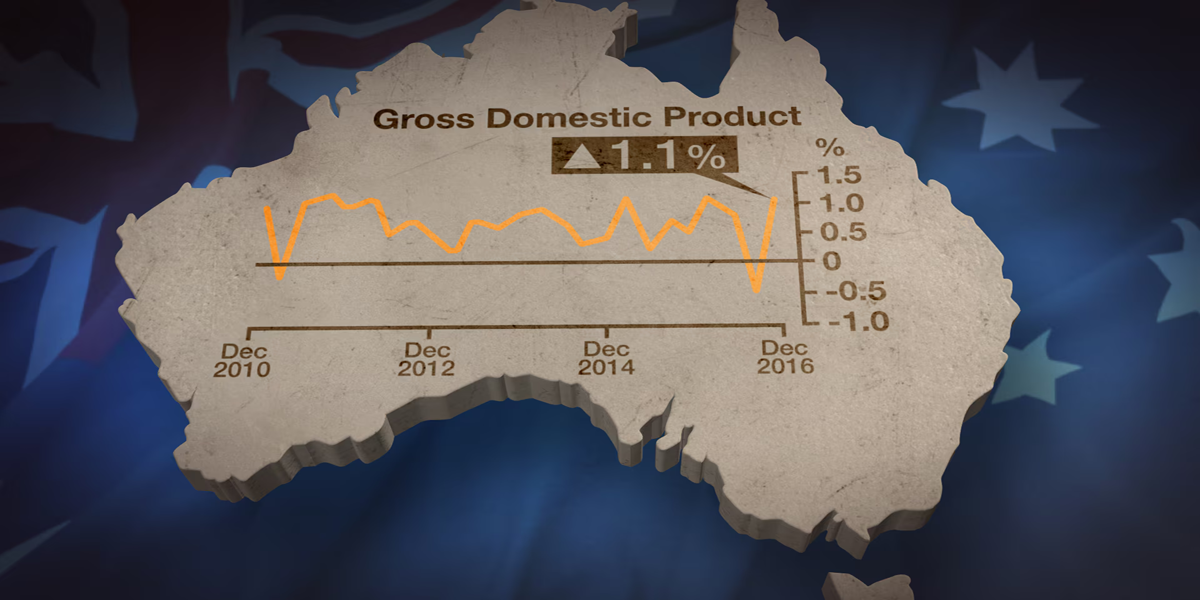

Australia's Green Investment Boom

In a contrasting development, Australia has witnessed a remarkable surge in green and sustainable investments, rising from $20 billion to $157 billion over the past five years. Despite a global retreat from green finance influenced by U.S. policy shifts under Donald Trump, Australian investors are increasingly backing projects with environmental benefits. The first half of 2025 alone saw $25 billion in green investments, putting the country on track to break previous records.

Investor Sentiment and Market Dynamics

David Hetherington, CEO of Impact Investing Australia, emphasized that while local investment funds have become more cautious about promoting their green credentials due to concerns over greenwashing, the demand for environmentally friendly projects remains strong. The Australian Retirement Trust has made significant commitments towards impact investments, indicating a robust investor appetite for projects that address climate challenges while generating returns.

Environmental Impact and Future Projections

Australian investments have collectively funded initiatives that have abated 110 million tonnes of CO2-equivalent emissions and planted 3 million trees. The trend indicates a growing recognition among investors, particularly younger Australians, of the importance of aligning financial returns with social and environmental impact. The rise in green bonds and dedicated impact investment funds suggests a shift in market dynamics, with states offering competitive returns for climate-focused projects.

Wrap-up

Ethiopia's urgent response to the Marburg virus outbreak highlights the ongoing challenges posed by infectious diseases, while Australia's green investment surge reflects a growing commitment to sustainability amid global political shifts. Both situations underscore the complexities of health and environmental issues on the international stage.

Sources

theguardian.com

theguardian.com

댓글목록0