Trump–Albanese Critical Minerals Pact Sparks Windfall for Australian M…

-

- 첨부파일 : 20251021_172352.png (972.1K) - 다운로드

본문

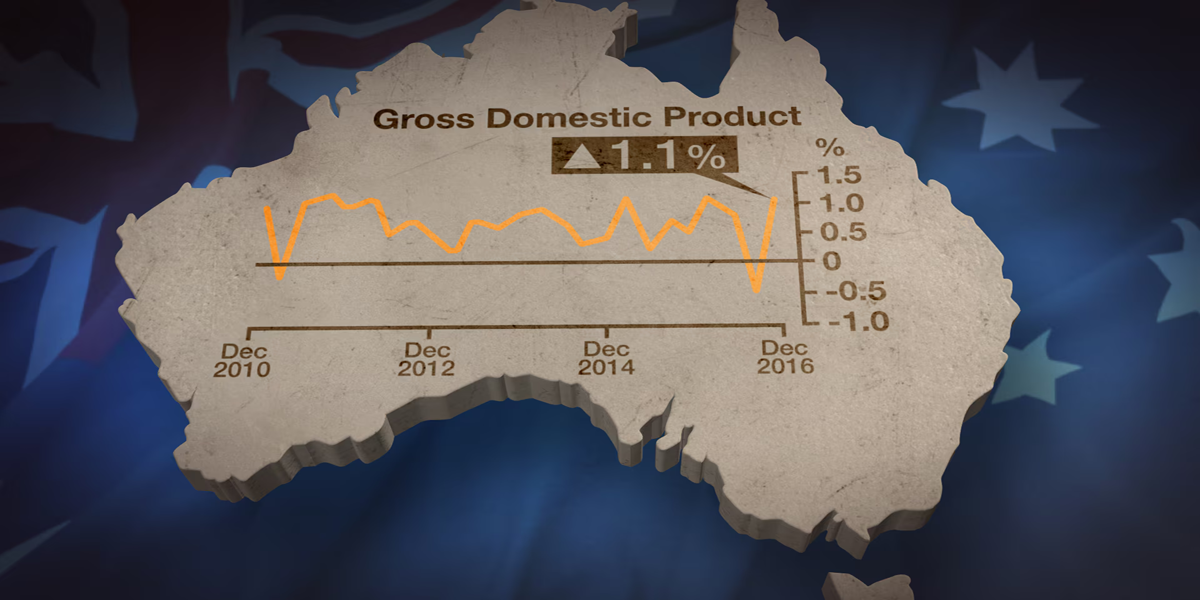

The United States and Australia have launched a multi-billion-dollar partnership to reduce China's grip on critical minerals and rare earth supplies — a move that has ignited a sharp rally in Australian mining stocks.

Under the agreement, announced by U.S. President Donald Trump and Australian Prime Minister Anthony Albanese, both governments will invest at least US$1 billion each over the next six months. The funding supports a planned US$8.5 billion pipeline of projects across both countries, securing alternative supply chains for rare earths used in electric vehicles, smartphones, wind turbines and advanced military technology.

Gina Rinehart-backed Arafura Rare Earths surged up to 29%, climbing 300% since last month after receiving financial support from the Australian government and the U.S. Export-Import Bank. VHM jumped more than 30%, while Northern Minerals rose 11% following tentative funding for its heavy rare earths project in Western Australia.

Arafura CEO Darryl Cuzzubbo said the partnership shows a “proactive approach to building a diversified rare earths supply chain.” Emanuel Datt of Datt Capital called it a serious step to reduce dependence on China. Investor interest has been intense: trading in rare earth stocks jumped elevenfold in October, according to Ausiex.

Lynas Rare Earths — the world’s only major processor of rare earths outside China — has tripled in value this year. Rinehart owns around 10% of Arafura and 8% of Lynas. However, the industry remains cautious, recalling when Chinese price cuts in 2011 forced many companies out of business. To prevent this, Washington and Canberra signaled they will consider price floors to shield producers from unfair trade practices.

Rare earths include 17 minerals essential for technologies and military systems. While not geologically scarce, they are costly to extract and process, and China dominates both mining and refining. An F-35 fighter jet alone requires over 400 kg of rare earth materials.

Australia confirmed funding for two priority projects: Alcoa–Sojitz’s Gallium Recovery Project in Western Australia and Arafura’s Nolans project in the Northern Territory. More projects are being considered in NSW, Queensland, Victoria and South Australia. In exchange for funding, both governments will secure long-term supply through offtake agreements.

UBS analysts welcomed the effort to rebuild a non-Chinese supply chain but warned that heavy government subsidies may push unviable projects into production.

Impact on China

Dr. Lian Sinclair of the University of Sydney said increased Australian supply could weaken China’s leverage, especially after Beijing restricted rare earth exports to the U.S. Still, he noted that from China’s viewpoint, this deal appears to be an incremental, not revolutionary, shift. He also warned that unless allied nations boost manufacturing capacity, demand for additional Australian output may remain limited.

댓글목록0

짜장먹고갈래님의 댓글